Part 24 Explained Market Capitalization: Types, Movement Meaning

Part 24 Explained Market Capitalization: Types, Movement Meaning

Market capitalization, or market cap, is the total value of a company's outstanding shares of stock.

It’s calculated as:

Market Cap = Current Share Price × Total Number of Outstanding Shares

It represents the market's perception of a company's worth and is a key metric for investors to gauge a company's size, risk, and growth potential.

It represents the total market value of a company’s equity.

Think of it as the market’s collective vote on what a company is worth at a given moment.

Below, I’ll explain the types of market cap, details, facts, and the factors that cause increases or decreases.

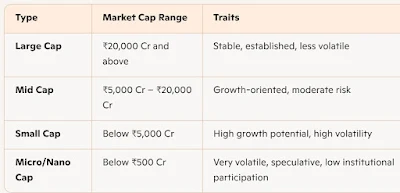

Large-Cap:

Definition: Companies with a market cap typically above $10 billion.

Characteristics:

Established, stable businesses (e.g., Apple, Microsoft, Reliance Industries).

Lower volatility and risk compared to smaller companies.

Often pay dividends and have consistent revenue streams.

Preferred by conservative investors seeking stability.

Example: As of June 2025, Apple’s market cap is ~$3.5 trillion (based on recent data).

Mid-Cap:

Definition: Companies with a market cap between $2 billion and $10 billion.

Characteristics:

Moderate growth potential with higher risk than large-caps.

Often in a growth phase, reinvesting profits into expansion.

Can be acquisition targets for larger companies.

Example: Companies like Zomato or Paytm (Indian context) often fall in this range.

Small-Cap:

Definition: Companies with a market cap between $300 million and $2 billion.

Characteristics:

Higher growth potential but also higher risk and volatility.

Often newer or niche companies with less access to capital.

Sensitive to economic downturns but can offer significant returns during bullish markets.

Example: Many startup IPOs in India, like Nykaa at its early stages.

Micro-Cap:

Definition: Companies with a market cap between $50 million and $300 million.

Characteristics:

Highly speculative and volatile.

Often young companies or those in niche markets.

Limited liquidity, making them riskier investments.

Example: Small, regional firms listed on exchanges like BSE SME.

Nano-Cap (less common):

Definition: Companies with a market cap below $50 million.

Characteristics:

Extremely speculative, often penny stocks.

High risk of failure but potential for outsized returns.

Low visibility and limited institutional investor interest.

Details and Facts About Market Cap -

Market Cap Reflects Market Perception:

It’s not the actual value of a company’s assets or revenue but the market’s valuation based on share price.

A high market cap doesn’t always mean a company is profitable (e.g., Tesla’s market cap surged despite inconsistent profits).

Used for Investment Decisions:

Investors use market cap to assess risk and return:

Large-caps: Lower risk, steady returns.

Small/mid-caps: Higher risk, potential for higher returns.

Market cap influences index inclusion (e.g., Nifty 50, S&P 500).

Free-Float vs. Total Market Cap:

Total Market Cap: Includes all outstanding shares.

Free-Float Market Cap:

Only includes shares available for public trading (excludes promoter-held or locked-in shares).

Many indices (e.g., Sensex, Nifty) use free-float market cap for calculations.

Dynamic and Fluctuating:

Market cap changes daily based on share price movements.

It’s influenced by market sentiment, economic conditions, and company performance.

Global Context:

The largest market caps globally are dominated by tech giants like Apple, Microsoft, and Nvidia (as of 2025).

In India, Reliance Industries, TCS, and HDFC Bank often lead in market cap.

Why and How Market Cap Increases or Decreases -

Market cap changes primarily due to fluctuations in share price, as the number of outstanding shares typically remains stable unless altered by corporate actions (e.g., stock splits, buybacks).

Below are the key factors that drive increases or decreases in market cap:

Factors Causing an Increase in Market Cap -

Rising Share Price:

Strong Financial Performance: Higher revenue, profits, or growth metrics boost investor confidence, driving up share prices.

Example: A company like Infosys reporting strong quarterly earnings.

Positive News: Product launches, new contracts, or acquisitions can increase investor optimism.

Example: Tesla’s market cap surged after announcing breakthroughs in battery technology.

Market Sentiment: Bullish market conditions or sector-specific trends (e.g., AI boom for tech stocks) can lift share prices.

Corporate Actions:

Issuing New Shares: If a company issues more shares (e.g., via a follow-on public offer) and the share price remains stable or rises, market cap increases.

Stock Splits: While a split doesn’t directly change market cap (it increases shares but reduces price proportionally), it can boost liquidity and investor interest, potentially raising share price.

External Factors:

Economic Growth: A strong economy or low interest rates encourages investment, pushing share prices higher.

Industry Trends: Companies in trending sectors (e.g., renewable energy, AI) often see market cap growth due to investor enthusiasm.

Example: Indian renewable energy firms like Adani Green saw market cap spikes during the green energy boom.

Factors Causing a Decrease in Market Cap

Falling Share Price:

Poor Financial Performance: Weak earnings, declining revenue, or high debt can erode investor confidence.

Example: A company like Byju’s faced market cap declines due to operational challenges.

Negative News: Scandals, lawsuits, or regulatory issues can tank share prices.

Example: Adani Group stocks plummeted after the Hindenburg report in 2023.

Market Sentiment: Bearish markets or sector downturns can drag down share prices.

Corporate Actions:

Share Buybacks: If a company buys back shares, the number of outstanding shares decreases, which may reduce market cap unless the share price rises significantly.

Delisting or Bankruptcy: If a company delists or goes bankrupt, its market cap effectively drops to zero.

External Factors:

Economic Downturns: Recessions or high interest rates reduce investor risk appetite, lowering share prices.

Geopolitical Risks: Events like trade wars or sanctions can negatively impact specific companies or sectors.

Sector Declines: A downturn in a specific industry (e.g., oil and gas during a shift to renewables) can reduce market caps of companies in that sector.

Market Cap Examples -

Why Market Cap Increases

Stock Price Rises: Most common reason. If demand increases (due to earnings, news, sentiment), price goes up → market cap rises.

New Shares Issued at High Valuation: IPOs, FPOs, or QIPs at premium prices can boost market cap.

Mergers & Acquisitions: Combining with or acquiring another company can inflate valuation.

Positive Earnings & Growth Outlook: Strong fundamentals attract investors, pushing prices higher.

Sectoral or Macro Tailwinds: If the entire sector is booming (like EV or AI), even average companies can see a cap surge.

Increase Example: Nvidia’s market cap soared to over $3 trillion in 2024 due to the AI boom, with its share price rising as demand for its chips skyrocketed.

Why Market Cap Decreases

Stock Price Falls: Due to poor earnings, negative news, or bearish sentiment.

Share Buybacks: Reduces outstanding shares, which can reduce market cap if price doesn’t rise proportionally.

Economic Downturns: Broader market corrections or recessions pull down valuations.

Dilution at Lower Valuation: Issuing new shares at a discount can reduce per-share value and cap.

Loss of Investor Confidence: Governance issues, fraud, or regulatory troubles can trigger sell-offs.

Decrease Example: Paytm’s market cap dropped significantly in 2024 after RBI restrictions on its payments bank, leading to a sharp decline in share price.